“Our economy is broken. Nothing symbolises that better than the spectacle of politicians demanding pay cuts from nurses whilst doing nothing to get City noses out of the ‘banking-billions’ trough.”

Sharon Graham, Unite the Union General Secretary

By Barckley Sumner, Unite Live

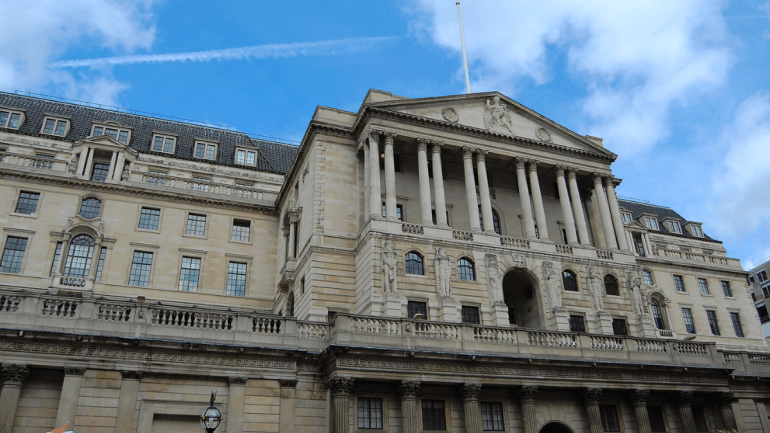

New research by Unite has revealed that the UK banking sector is making bonanza profits on the back of Bank of England interest rates increases.

In the first nine months of 2022, the big four UK banks (Barclays, HSBC, Lloyds and NatWest) recorded profits of £19.8 billion. Since the end of 2021, big banks’ bank net interest income has increased by 37 per cent.

On the day (February 2) when interest rates were raised by 0.5 percentage points to 4 per cent – boosting bank profits – Unite has called on the government to impose a windfall tax, placing a cap on big banks’ profiteering.

Unite general secretary Sharon Graham said, “It’s time the truth was told. Interest rate rises are putting the fear of death into households across Britain, but we know now that at the same time they are delivering billions in excess profits to the big City banks.

“Our economy is broken. Nothing symbolises that better than the spectacle of politicians demanding pay cuts from nurses whilst doing nothing to get City noses out of the ‘banking-billions’ trough.

“That’s why I am calling for a windfall tax on the excess profits of the big banks. Workers did not create this crisis and they should not be the ones to pay for it. It’s time the profiteers and their friends in the city were told profiteering won’t pay and it’s time they paid their fair share.”

Post-pandemic, the top banks have made more money than at any point since the financial crash. Since the Bank of England chose to start raising interest rates, the big four’s profits have grown three times more quickly than workers’ incomes and twice as fast as profits for all companies.

The excessive profits in the sector, principally generated by interest rate rises, cannot be allowed to go on and on when millions are in fear of the fuel bill and cannot feed their children properly.

- This article was originally published by Unite Live on February 2nd, 2023.

- You can follow Unite the Union on Facebook, twitter and Instagram.